Rising Inflation in India

They say in politics, people have short memories. But not when it comes to inflation. Inflation or the consistent increase in the general price level occupies a central place in the collective Indian psyche and is synonymous with economic hardships. Excess demand, which could be caused by several factors, leads to a spike in prices. The spike, in turn, triggers off a chain of events, ultimately resulting in reduced purchasing power, rendering the economy poorer. Perceived as a form of tax imposed without legislation, inflation has severe political, social and economic ramifications.

Over the last two decades, inflation has emerged as a leading concern for policymakers and citizens in India.

Even prior to the pandemic, consumer inflation had already crossed the upper tolerance level of 6% in December 2019. Government revenue from taxes slumped to its lowest since 2000-01, as Nominal GDP growth fell to just 7.2% (the lowest since 1975-76). This revenue shortfall has led to higher excise duties on fuel, exacerbating inflationary pressures.

Thus, we were already in the midst of a cyclic economic slowdown. Add to this already ominous situation, the outbreak of the Covid-19 pandemic. What followed were simultaneous worldwide lockdowns as India joined the global economy in an unprecedented contraction in 2020-21. Perhaps the most tangible fallout of the pandemic: something that affected each and every individual, was the impact of inflation.

What is the reason for inflation in India this time?

Supply-side disruptions seem to be driving inflation. Lockdowns all over the world have disrupted manufacturing and dented supply chains causing a situation of excess demand, pushing prices up. Also, the asynchronous revival of demand, with richer countries opening up first, has led to the increase in prices of crude and metals, worsening inflation. Higher crude and commodity prices coupled with high fuel taxes are exacerbating inflationary pressures in India.

Having said these, one cannot ignore the possible link between policy actions and inflationary pressures. The year 2020 witnessed a slew of conventional and unconventional measures across the world, with monetary authorities slashing policy rates to zero and below in real terms - and even in nominal terms in some countries - while executing massive asset purchase programmes, payment deferral schemes, emergency funding avenues, etc. The stimulus provided by fiscal authorities amounted to US$ 16 trillion (15.3 percent of the GDP). The vast fiscal and monetary expansion in several developed countries could entrench higher inflation in their economies, and thus globally through asset prices. A policy-induced expansion in the US could be instrumental in exporting inflation to the emerging world.

What do inflation numbers look like presently?

Consumer Price Index (CPI), which measures the change in prices of a specific basket of consumer commodities purchased by a specific class of households, is a leading index for measuring retail inflation. In India, it peaked above the acceptable barometer of 2%-6% for both May and June.

As demonstrated in the graph above, CPI numbers for May and June were 6.3% and 6.23% respectively. The average CPI inflation in Q1 FY 21-22 stands at 5.6%, which also crosses the RBI’s projection of 5.2% in the last Monetary Policy Committee (MPC) meeting.

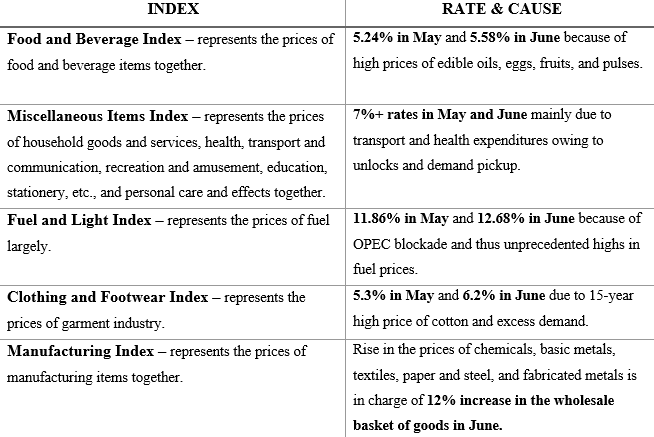

Here’s a category-wise analysis:

Policymakers' response to Inflation is inevitably based on their perception of its' nature. Let's take a look at what has been the approach in India, this time over:

Inflation in India: Transient or Structural?

There are many who argue that this inflation is transitory (temporary), owing to the complexity of global supply chains and the large-scale disruptions caused to them. The other view is that it is structural (resulting from shifts in demand and supply) in nature, a view that cannot be ignored in the face of rising core inflation.

The RBI has maintained its ‘accommodative’ monetary policy stance since June 2019, despite the pandemic. According to The Monetary Policy Committee (MPC), the current spike in inflation is transitory and therefore any hurried action could completely undo the process of economic recovery which is anyway nascent and hesitant, and create avoidable disruptions in the financial markets. In the words of RBI governor Shaktikanta Das, “It is not like any other year or occasion, when inflation goes up, you start tightening the monetary policy”.

This leads us to ask: does debt management surpass inflation-targeting for the RBI?

Inflation represents a situation of excess demand. To keep inflation under check, monetary authorities ordinarily raise interest rates. This, leading to the correction of excess liquidity, is known as Inflation-targeting. However, if interest rates rise, it would adversely affect government debt since the cost of borrowing would increase, thus hampering the RBI's primary function - debt management for the government.

Critics opine that in the face of a huge revenue shortfall, the Centre’s fiscal stimulus is not adequate to push growth and that the RBI’s debt management function is taking precedence over inflation targeting.

Having said all of these, one may ask: Why should inflation be a problem?

Prolonged inflation is bound to have severe consequences. The fear of the surging liquidity eventually parking itself in asset prices, is not unfounded. China's extraordinary stimulus during the 2008 financial crisis had pushed commodities into a 2-year high, leaving economies like India unable to weather the external stimuli. This time, it is the US that is seemingly unrestrained in its fiscal response. The RBI is aware of the possibility that asset prices may come unanchored from the real economy, pointing out in its recent monthly report that “liquidity injected to support economic recovery can lead to unintended consequences in the form of inflationary asset prices and liquidity support cannot be expected to be unrestrained and indefinite”.

Conclusion

The situation today, characterised by prolonged inflation and low growth, arguably resembles the ‘Stagflation’ of the 1970s. India’s GDP shrank by 7.3% in 2020-21 and Moody’s downward revision for the current fiscal year from 13.9% to 9.6% belie hopes for a V-shaped recovery.

Ultimately, the RBI has to choose between debt management and inflation targeting. Ahead of its monetary policy statement on August 6th, it has to decide which segment of the market merits more attention for balancing the scales of demand and supply. Withdrawing abruptly would spook markets and lead to a spike in borrowing costs across the board. But, an unchecked liquidity expansion would inflate asset prices even more.

In the words of John Kenneth Galbraith, “Nothing so weakens a government as persistent inflation”. With the crucial Uttar Pradesh Assembly elections due in early 2022, the government’s response to inflation now could potentially decide India’s fate in the following decade: both economically and politically.

That’s all for this week! We hope you liked it and would love to know your thoughts in the comment section. This article is written and curated by Kashish Agarwal and Nirupama Banerjee.

(Kashish Agarwal is a 2nd year student pursuing B.Sc Economics(H) at St. Xavier’s College (Autonomous), Kolkata and a Junior Associate of the Xavier’s Finance Community.)

(Nirupama Banerjee is a 2nd year student pursuing B.Sc Economics(H) at St. Xavier’s College (Autonomous), Kolkata and a Junior Associate of the Xavier’s Finance Community.)

References: